Why Use An Insurance Broker?

Key takeaways:

- Brokers are independent of all insurance companies, able to offer a variety of options and make impartial recommendations.

- Use a broker for their industry/sector expertise, identifying day-to-day business risks, and for tailoring an insurance package that meets your needs.

- Opting for a cheaper ‘off the shelf’ insurance policy is often not the best approach for insuring your business correctly.

Small business owners tend to be born optimists – passionate, resilient and driven – but running a small business can certainly come with its own risks and challenges. That’s why it pays to have an insurance broker in your corner who can help accurately identify and protect the day-to-day risks your business faces.

Whatever business you’re in, finding the right level of insurance should be top priority to ensure you are properly protected. However, insurance can be incredibly complicated to fully understand due to the broad range of risks faced, the various packages and costs available, and even the fine print that define the terms & conditions.

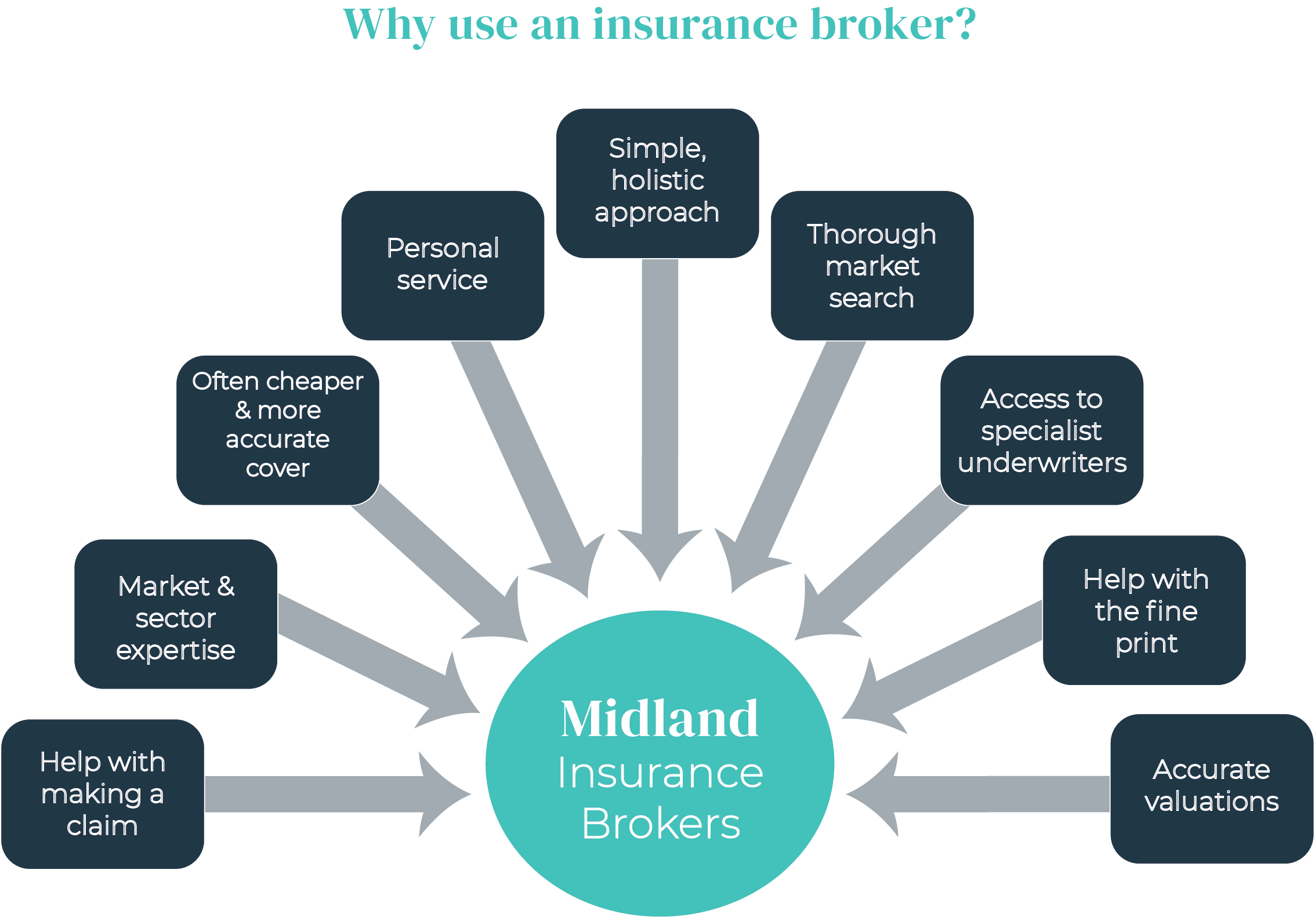

Compared to buying directly, using an insurance broker has a variety of benefits, some of which can include:

-

negotiation of better premiums or conditions

- an independence of any one insurer – unbiased and impartial advice

- explaining aspects of your policy that you may not have considered

- offering you a wide range of plans

- save you considerable time and effort

- tailored packages to meet your specific business needs

- meeting face-to-face upon request

Additionally, larger and more specialised brokers like www.midlandinsurance.com.au have the capacity to offer a range of value-added services such as assistance with claims, employee education and contract renewal support, all of which are often included at no extra cost.

So, whatever your small business, it’s worth investing a little time and effort into finding an insurance broker that’s right for you. Because at the end of the day, they are there to act in your best interests, provide you with sound and rational advice, and ultimately help you and your business succeed.

The below animation further helps explain the key benefits of using an insurance broker.

If you would like to chat with one of our highly experienced brokers to gain a free assessment of the insurance coverage protection that is available for you and your specific business, please drop us a line, via email or phone 1300 306 571.