Key takeaways:

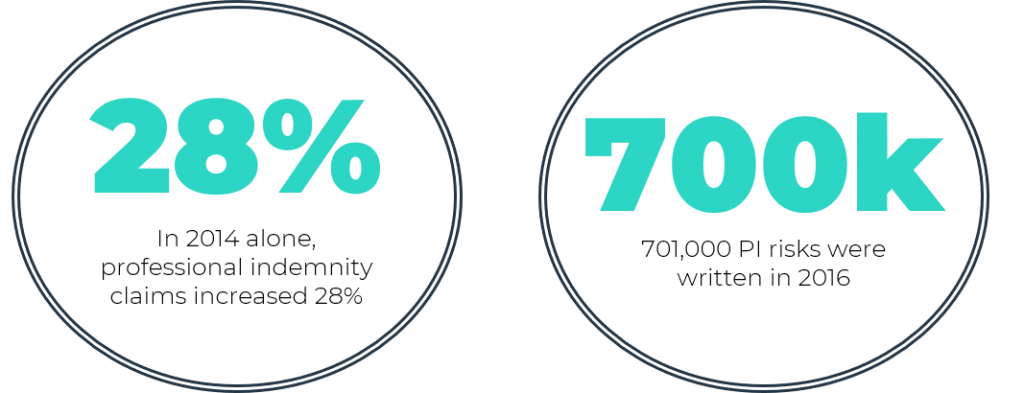

- Professional indemnity (PI) insurance is vital for anyone who provides professional services or advice to clients in exchange for a fee.

- PI is a wide-ranging insurance claim solution that protects individuals against legal costs and claims for damages due to an error or act of omission throughout the course of business. Basically, it is cover that protects you and your business if you “fail to present work to a professional standard”

- PI is mandatory in some industries, such as medicine, accounting, law, engineering, real estate, photography, building, marketing, architecture or finance.

“If you own a business, you can be liable for damages or injuries to another person or property … consider professional indemnity insurance for your business if the likelihood of legal action is high.”

Australian Government – Business.gov.au

In our blame-culture society, professional indemnity insurance becomes a crucial component in helping protect your business against claims of professional misconduct, malpractice, errors, omissions, or breach of contract.

What could lead to a claim?

Without PI cover, such claims can end up having devastating affects on your business or even cripple it altogether. It not only puts your business at risk either. Your personal assets, such as your house, can be affected, as well as the people you work with, including partners, employees and volunteers.

The greatest value in a PI policy is the cover against legal defence costs.

Even if you pride yourself on meticulous work, there’s a chance you could still be sued unfairly by a client who is merely dissatisfied. Even though they might have no valid claim, the allegation could still involve you in substantial legal costs and non-productive time.

Whether you’re found liable or not, if a claim is brought against you, a PI policy will be able to pay for all of your legal costs to defend that action.

A professional indemnity policy can save you from personal bankruptcy or permanent closure of your business.

A couple of things to consider…

What is the Sunset Clause?

The sunset clause in an insurance policy sets a deadline for filing claims once a policy has expired. For example, an architecture firm may buy a policy with a sunset clause of 3 years to cover it while it designs a large renovation project. Even though the policy will expire before the designs are completed, the insurance company will continue to respond to claims filed 3 years afterward.

What’s the difference between Public Liability and Professional Indemnity?

Public liability cover is for damage to another person or their property, whilst professional indemnity covers your liability for failing to produce work to a professional standard.

Professional Indemnity in practice…

Example: A landscape architecture firm is sued by their client for the costs of rectifying an extension built from a flawed design. The PI policy reacts and the insurer pays out $50,000.

Example: A logistics company is sued by a competitor for copyright infringement and intellectual property theft relating to their business model and their website. The PI policy reacts and the insurer pays out $250,000.

Example: A construction company discovers a fault in the plans, and the building then needs to be demolished and rebuilt from scratch. The property developer sues for $500,000 in damages due to loss of income and value of business. The PI policy reacts and the insurer pays out $500,000.

Leave A Comment