Key takeaways:

- Brokers are independent of all insurance companies, who act in your best interest and offer impartial and unbiased advice.

- Use a broker for their industry/sector expertise, identifying day-to-day business risks, and for tailoring an insurance package that meets your needs.

- Opting for a cheaper ‘off the shelf’ insurance policy is often not the best approach for insuring your business correctly – brokers can usually negotiate better premiums or conditions.

Using an insurance broker means clear advice, more choice and a better price tailored to your business needs.

Small business owners tend to be born optimists – passionate, resilient and driven – but running a small business can certainly come with its own risks and challenges. That’s why it pays to have an insurance broker in your corner who can help accurately identify and protect the day-to-day risks your business faces.

Whatever business you’re in, finding the right level of insurance should be top priority to ensure you are properly protected. However, insurance can be complicated to understand due to the broad range of risks businesses face, the various packages available and associated costs, and even the jargon in the contract and fine print that defines the terms & conditions.

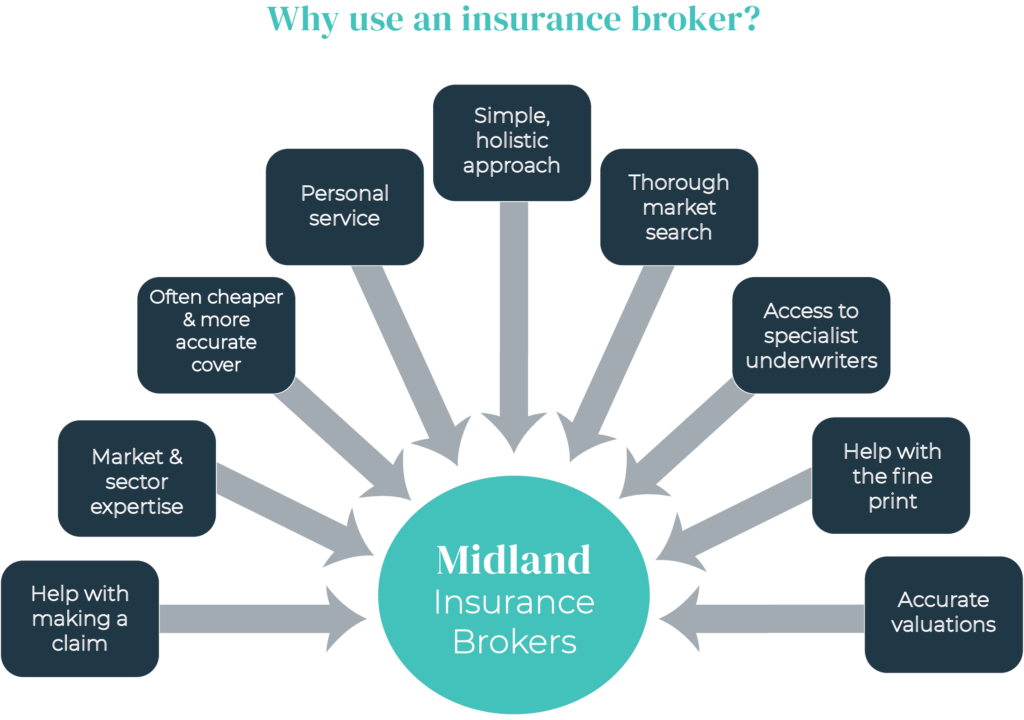

Brokers are independent of any insurer and can therefore explain aspects of your policy or note things that you may not have considered. Compared to buying directly, brokers can offer a wide range of plans, tailor packages to meet your specific business needs, make impartial recommendations, meet face-to-face on request, and even negotiate better premiums or conditions.

In addition to the above benefits, specialised brokers like Midland can offer a range of value-added services such as assistance with claims, employee education and contract renewal support, all of which are often included at no extra cost.

A broker ensures your claim is presented to the insurer in a clear and legible way to assist in a speedy settlement.

Whatever your small business, it’s worth investing a little time and effort into finding an insurance broker that’s right for you. At Midland, we’re here to ‘uncomplicate the complex’ – clear, simple advice on insurance, tailored to help you and your business succeed.

Check out the below short video for more information…

If you would like to chat with one of our brokers for advice, to analyse your existing policy, or to gain a no obligation free quote, please drop us a line.

1300 306 571

contact@midlandinsurance.com.au

DISCLAIMER:

This article is informational only and should not be construed as individual advice as it does not consider your individual needs. You should consider if the insurance is suitable for you and read the Product Disclosure Statement or policy Wording before buying insurance.

Leave A Comment