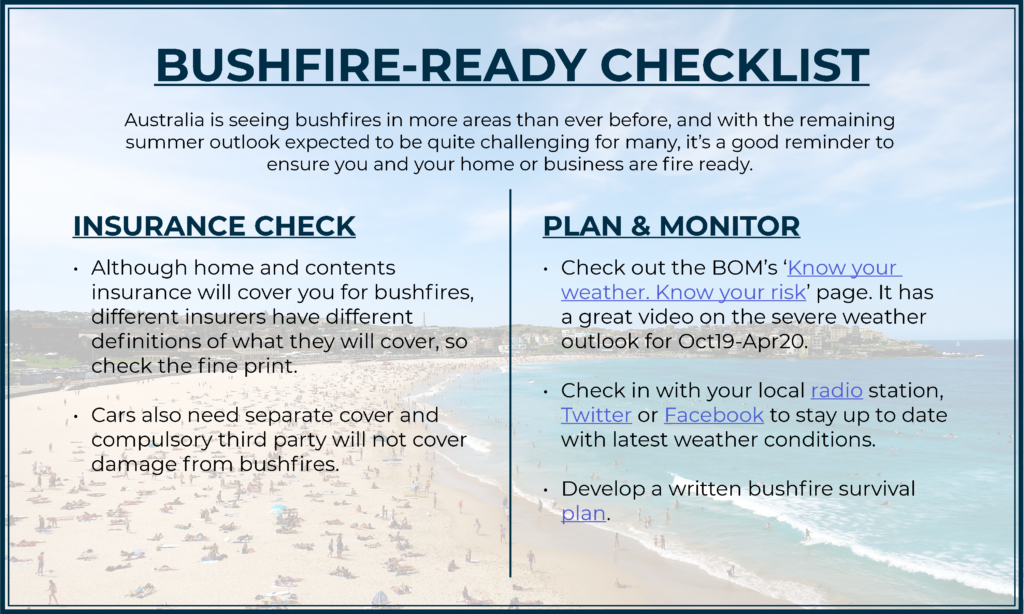

Australia is seeing bushfires in more areas than ever before, and with the remaining summer outlook for most of the country expected to see below average rainfall, drier-than-average conditions and an increased risk of early heatwaves and fires, it’s crucial that you and your home (or business) are bushfire-ready.

Getting to know your weather and the risks that come with it, who better to look to than those who do it best; The Bureau of Meteorology (www.bom.gov.au). The BOM have an in-depth ‘knowledge centre’ on their website where they showcase easily digestible and informative video content, as well as mapped historical and forecast data. Understanding how severe weather events happen, knowing it’s on the way and being ready to act are the bureau’s main objectives to help you stay safe.

A couple of key sections:

Climate outlooks – rainfall and temperature forecasts for weeks, months and seasons, along with a solid video overview of their Dec-Feb forecast, all distilled down to only 3 minutes and 40 seconds: http://www.bom.gov.au/climate/outlooks/#/overview/summary

Severe weather information – a video-led hub to help educate and prepare you for all hazardous weather events, such as: heatwaves, bushfires, droughts, floods, cyclones and thunderstorms. http://www.bom.gov.au/knowyourweather/?

In addition to the above, we’ve noted a few handy links below which can help keep you up-to-date with local news and emergency services information. The Apple and Google app stores also have dedicated bushfire warning apps specific to your state as well, which will be especially helpful if you’re on the move.

- Radio stations: http://reception.abc.net.au/

- ABC Twitter: https://twitter.com/abcemergency

- ABC Facebook: https://www.facebook.com/ABCemergency/

- QLD: https://www.qfes.qld.gov.au/Pages/default.aspx

- NSW: https://www.rfs.nsw.gov.au/

- VIC: http://emergency.vic.gov.au/respond/

- WA: https://www.emergency.wa.gov.au/

- TAS: http://www.fire.tas.gov.au/

If you don’t currently have a bushfire survival plan in place, the Victorian CFA have created a terrific 8-page template you can use, filled with preparation techniques, various checklists, key contact info and emergency kit suggestions: https://bit.ly/2RWTtsq.

Finally, it is worthwhile checking your home and contents insurance policy. Although it will cover you for bushfires, each insurer will have different definitions of what they cover, so don’t forget to check the fine print.

DISCLAIMER:

This article is informational only and should not be construed as individual advice as it does not consider your individual needs. You should consider if the insurance is suitable for you and read the Product Disclosure Statement or policy Wording before buying insurance.

Leave A Comment