With the number of confirmed cases of those infected with the coronavirus (COVID-19) growing every day, it has become somewhat of a nightmare for many countries and their economies.

The COVID-19 virus has already had a significant negative impact on the global economy, including the Australian economy. Recent import/export restrictions and sweeping travel bans have caused considerable disruption to both businesses and travellers alike. And understandably, one of the main concerns is around whether their insurance policies will respond should they be impacted by the outbreak.

As of the 23rd of January 2020, the Australian government placed coronavirus as a listed disease (i.e. a “known event”) under the Biosecurity Act 2015.

CORONAVIRUS & BUSINESS INTERRUPTION INSURANCE

- For business package policies: once a disease becomes a “known event”, all, but a few, policies exclusions will take effect. This unfortunately means there is no insurance protection for disruptions to businesses arising from COVID-19.

Traditionally, business interruption policies only cover disruption to a business as a result of damage to ‘insured property’. However, over time, insurers widened the protection to provide coverage for things such as an outbreak of Legionnaires disease, or a measles outbreak which closes down one or two buildings disrupting a small number of businesses. A few policies have been known to provide coverage for an outbreak up to 50 kilometres from the business location, however most policies will only cover an infectious disease that occurs on the premises itself.

Ultimately, the cover afforded by both business packs and standard Industry special risks policies are not intended to cover disruption caused by an outbreak in a different state, let alone a different country.

CORONAVIRUS & TRAVEL INSURANCE

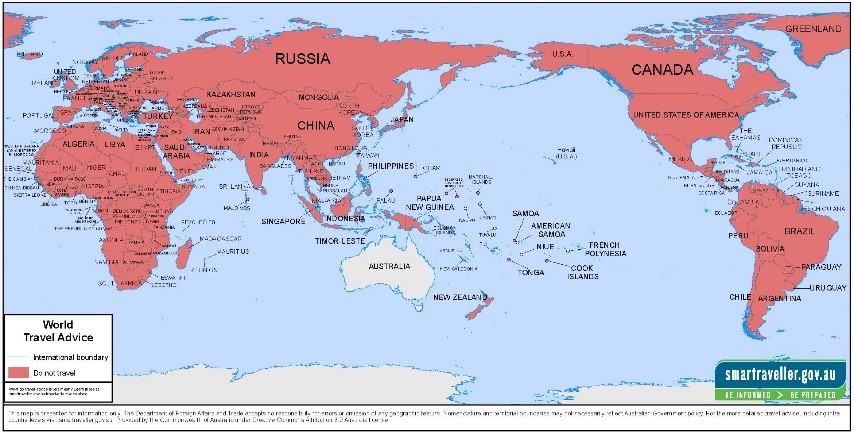

As of the 18th of March, the Australian Government issued a level 4 “do not travel” alert, applicable to all overseas destinations. This is their highest advice level.

- For travel policies taken out before the 23rd of January 2020 – you may be covered for medical expenses that arise from contracting the disease overseas, and may even be covered for cancellation expenses. Make sure you also check with your broker or insurance provider as to whether your policy has specific exclusions around epidemics or pandemics.

- For travel policies taken out on or after the 23rd of January 2020 – once a disease has been listed as an epidemic or pandemic, if you start a new policy you won’t be covered for any coronavirus-related claims. Insurers would expect that you entered the policy with the knowledge of potential loss.

For leisure travel policies (bought before 23/01/2020), you should be able to reclaim some of your lost expenses. Before you can do this, you’ll need to see if your travel service provider is willing to refund you directly or provide some other alternative.

For corporate travel policies that were taken out or renewed before 23/01/2020 are likely to provide coverage for cancellation of trips to countries that are at ‘Level 4 – Do Not Travel’.

However, if you still decide to travel while the “do not travel” alert is in effect, your travel insurance policy will become void.

A number of major airlines have suspended or reduced flights all over the world, including Qantas, Virgin Australia and Jetstar. However, airlines are also offering refunds or free rescheduling services to affected customers, so you shouldn’t be out of pocket for the cost of your ticket.

As for your other pre-paid travel expenses like accommodation, cruises or tours, you may be able to claim back your losses with travel insurance if your plans have been impacted by the cancellations or delays.

Any insured person contemplating travel should refer to both the WHO (https://www.who.int/) and Smartraveller (https://www.smartraveller.gov.au/) websites for the latest information.

As with any other threat, it is also important to consider what risk management measures you can introduce to mitigate the risk to yourself, your business and the broader community. Below is a list of health and safety tips to help avoid infection and minimise the spread of coronavirus.

HEALTH & SAFETY TIPS

- Wash your hands with soap when visibly dirty, after preparing food, using the bathroom, blowing your nose or sneezing, and after handling rubbish.

- Apply alcohol-based hand sanitiser frequently throughout the day.

- Avoid biting your nails, putting hands in your mouth or rubbing your eyes.

- Boost your immune system by eating well, exercising, having enough sleep, and keeping your stress levels under control.

For organisations

- Implement a work-from-home regime for employees

- Cancel any non-essential business travel

- Provide sanitised hand washing stations for use by staff and visitors.

- Protect the mental wellbeing of employees concerned about the coronavirus.

For travellers

- Follow the advice of local authorities as well as travel warnings stated by the WHO and Smartraveller websites.

- Wash your hands often with soap and water or alcohol-based hand sanitiser, particularly after coming in contact with animals or animal products.

- Remain alert for updates and advice from the relevant authorities on additional steps to manage the spread of the disease.

If you have any questions about your existing policy and would like to speak with one of our brokers, please give our Melbourne office a call on 03 9340 0100, or Sydney office on 02 9634 0900.

DISCLAIMER:

This article is informational only and should not be construed as individual advice as it does not consider your individual needs. You should consider if the insurance is suitable for you and read the Product Disclosure Statement or policy Wording before buying insurance.

Leave A Comment